With 300 million smartphone users [1], an average mobile data cost of £0.05 per gigabyte, an average age of 25 years [2] and an insurance penetration at 3.69% of GDP [3], India presents an exciting opportunity for InsurTech to transform lives, enables businesses and facilitate growth.

Although the Indian InsurTech ecosystem is small, I’ve noticed that insurance (and technology) press in the West does not highlight the progress that is being made. In this brief article, I will provide a high-level overview of the Indian InsurTech ecosystem through a thematic discussion.

Theme I: Regulation as an enabler

It is fair to commend the FCA for promoting the concept of a Regulatory Sandbox which has served as a catalyst for innovation in the UK. Other regulators such as the Monetary Authority of Singapore (MAS) and the Hong Kong Monetary Authority (HKMA) have adopted similar approaches. Thus far, the IRDAI (India’s insurance regulator) has issued licenses to Acko, Digit, COCO by DHFL and Reliance Health Insurance to operate as full-stack insurance carriers (“neo-insurers”).

It is interesting to note the divergent approaches taken by these neo-insurers:

- Acko focuses on high frequency low premium policies – notable is its partnership with Ola Cabs to offer trip micro-insurance policies to passengers; roughly 20 million policies are sold per month [4].

- Digit focuses on low frequency high premium policies – motor insurance makes up the bulk of its book [5] and the firm is looking to launch its health insurance offering this FY [6].

- COCO (Connected Coverage) by DHFL lays emphasis on two-wheeler and four-wheeler insurance but offers other general insurance policies.

- Reliance Health Insurance began operations in December 2018 as a standalone health insurer.

I believe issuance of licenses constitutes passive regulatory engagement whereas a sandbox-style initiative constitutes active engagement. The latter is where India is heading this FY.

Over the past few months, the IRDAI has been exploring the global InsurTech ecosystem. This has culminated in the publication of an exposure draft on 16th May to invite comments regarding a proposed InsurTech Regulatory Sandbox – modeled along the lines of the FCA Regulatory Sandbox. Readers interested in examining these documents in more detail may find these links useful [7][8][9].

Theme II: Incumbent engagement

It would be unfair for me to not recognize and commend Indian insurance companies for embracing “digital” India. Although examples are plentiful, I will focus on the few that stand out.

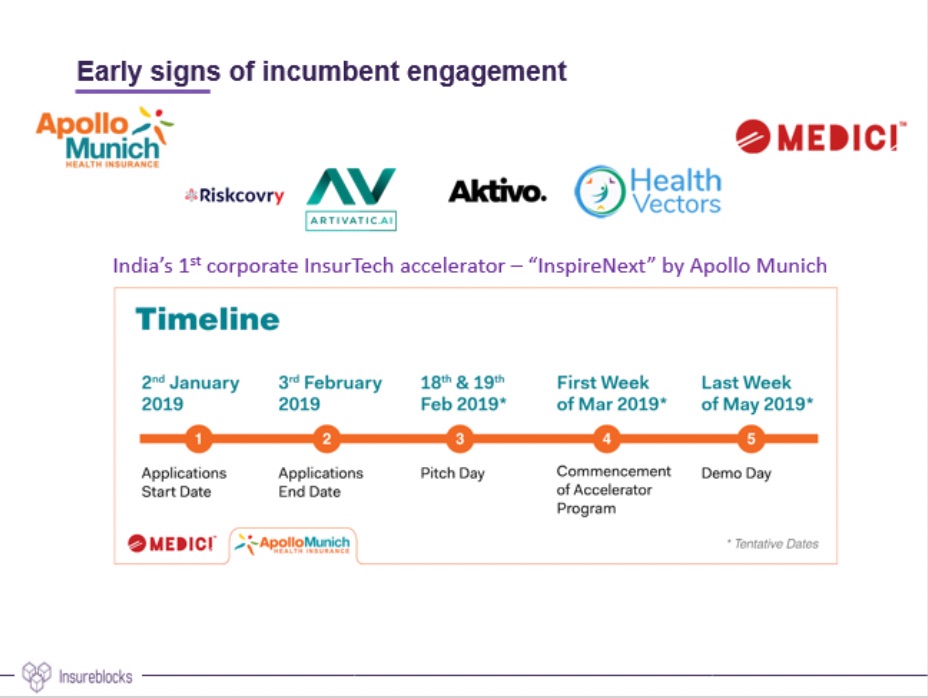

Apollo Munich Health Insurance – ‘InspireNext’ Accelerator

In partnership with innovation studio MEDICI, Apollo Munich, a standalone health insurance company, launched ‘InspireNext’ – India’s 1st corporate (health) insurance accelerator programme. The international audience may view this programme in the same light as Collab by MetLife [10]. InspireNext is an open innovation forum where business units define their problem statements and start-ups pitch their solutions. Readers interested in finding more details regarding the programme and cohort I may find these links useful [11][12].

In partnership with innovation studio MEDICI, Apollo Munich, a standalone health insurance company, launched ‘InspireNext’ – India’s 1st corporate (health) insurance accelerator programme. The international audience may view this programme in the same light as Collab by MetLife [10]. InspireNext is an open innovation forum where business units define their problem statements and start-ups pitch their solutions. Readers interested in finding more details regarding the programme and cohort I may find these links useful [11][12].It suffices to say that Apollo Munich may be a first mover in this regard. However, expect other Indian insurance companies to follow suit. Please note that the participation of Singapore headquartered Aktivolabs suggests future opportunities for non-Indian InsurTech firms may arise.

Miscellaneous examples of incumbent participation

Notable amongst these partnerships are:

- ICICI Lombard partnered with mobile wallet provider MobiKwik to provide cyber insurance to MobiKwik users (sum assured £550 for a monthly premium of £1) [13].

- HDFC Life partnered with telecom Airtel to offer term life insurance cover (sum assured £4440) as part of a monthly prepaid package costing £3 [14].

- Various incumbents have partnered with Toffee Insurance to offer “bite-size” (or contextual) insurance products. For example: bicycle insurance with Tata AIG [15] and renters insurance with Future Generali.

I believe incumbent engagement is critical for an InsurTech ecosystem to grow since it reduces the barriers to entry for innovative start-ups to offer products. In the UK, the MGA arrangement is popular. Along similar lines, the “corporate agency” license (held by Toffee Insurance, for example) offered by the IRDAI will help InsurTechs offer products underwritten by partner carriers [16].

At this stage, you may ask – “Why should I take an interest in the Indian InsurTech ecosystem?” The next theme shall aim to address this question.

Theme III: Interconnectedness of InsurTech ecosystems

It should not surprise you when I say that India is connected to the rest of the world – this applies to the insurance industry as well. You may be familiar with Zasti and Pentation Analytics. Not only are Indian InsurTech start-ups going global but also foreign InsurTech start-ups are entering India.

It should not surprise you when I say that India is connected to the rest of the world – this applies to the insurance industry as well. You may be familiar with Zasti and Pentation Analytics. Not only are Indian InsurTech start-ups going global but also foreign InsurTech start-ups are entering India.- GOQii (India) is a lifestyle, fitness and wellness ecosystem centered around a proprietary wearable device. It offers teleconsultation, provides educational content and leverages gamification to provide rewards (ties back to health and life insurance). Through a strategic investment by Mitsui, GOQii is expanding to Japan this FY [17].

- Aktivolabs (Singapore) is participating in the InspireNext programme by Apollo Munich. Aktivo’s proprietary Aktivo Score serves as a barometer for health and longevity [18].

- Skyline Partners (UK) plans to enter the Indian crop insurance market with a weather-based insurance product in H1 2019. [19] Recent government initiatives such as the ‘Pradhan Mantri Fasal Bima Yojna’ (Prime Minister’s crop insurance scheme) [20] are indicative of the central government’s interest in this regard.

So, let me ask you this, if UK-based Skyline Partners is entering India, when are you?

Closing words

In this article, I’ve used a fact-based approach to provide a high-level overview of the InsurTech ecosystem in India. The three themes are: regulatory buy-in, incumbent engagement and interconnectedness of InsurTech ecosystems.

There are gaps in the Indian insurance market – especially in cyber insurance and in commercial (particularly, SME) insurance. The landscape is indicative of the fact that India may soon be ready to invite foreign participants within its nascent InsurTech ecosystem.

Additional resources

Readers who may be interested in exploring the Indian InsurTech ecosystem further may refer to an open-source spreadsheet on products offered within the Indian InsurTech ecosystem, the LinkedIn “InsurTech in India” group and the Asia InsurTech podcast.

About the author

Rahul Mathur is a Research Analyst at Insureblocks where he tracks InsurTech, FinTech and HealthTech in emerging markets. A recent graduate from University of Warwick, he is a part-qualified actuary with an academic interest in federated learning, cryptography and privacy preserving techniques.

Queries, comments and feedback may be directed via email to rahul@insureblocks.com or via social media platforms such as LinkedIn and Twitter.

Disclaimer

Views expressed are the author’s own and do not reflect those of Insureblocks, its management, affiliates or clients. The author does not have any financial or other stake (direct or otherwise) in any entity quoted within this article. This article has been produced for educational purposes to be circulated within the InsTech London community and beyond. Further, this article should not be treated as legal, financial or any other form of advice. The author is not liable for financial or other losses that may arise to the reader or an affiliated party as a result of information presented herein.